Did you know that according to a national survey, over 75% of consumers that receive marketing postcards in the mail, not only read them but keeps them for weeks or more?

With this in mind, it just makes sense for real estate postcards to be a part of your marketing strategy. The following are three tricks to help you begin winning big with postcard marketing.

Direct response marketing

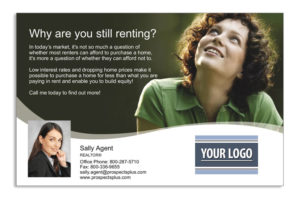

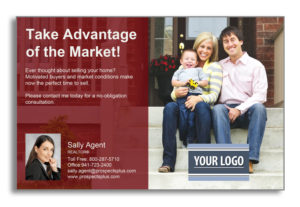

The intent of direct response marketing is to elicit a measured and often emotional response from your prospects. Methods used to trigger this response include a call to action, a question or something that compels your audience to reply.

A great example of direct response marketing using a question is shown in one of our Expired Postcards. The postcard reads, “Did you know more than 90% of people who have had the misfortune of having their listing expire change agents to help improve their ability to sell sooner rather than later?” Quoting statistics is a great way to lend credibility to a point you are making.

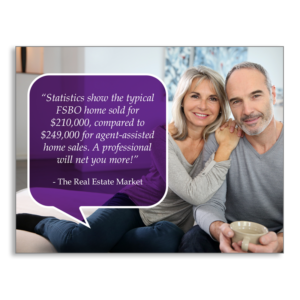

Another direct response option is educating your prospect, by raising their awareness and showing your expertise. An example of this is shown in one of our Market Quote Postcards. It reads, “Statistics show the typical FSBO home sold for $210,000, compared to $249,000 for agent-assisted home sales. A professional will net you more!” Again, the use of statistics helps validate the statement.

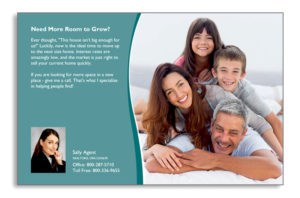

The last direct response example uses a “call-to-action” that gives your prospect an exciting reason to contact you that benefits them personally. An example of this is demonstrated in our Free Offer Postcards. These postcards contain offers for a “Free Home Market Analysis”, “Free Home Lists” or a “Free Home Equity Analysis”. Providing exactly what the consumer is in need of and at no cost to them makes it easy for them to raise their hand.

Keep in mind, although you may be tempted to send a postcard with a beautiful image and/or saying, because it’s simple and you know it will be readily accepted, be careful it’s not your only choice, specifically over compelling direct response content.

Most of all, remember a postcard has limited, valuable real estate available on the front and back. So make the most of this space with the right images and copy to drive home your point and gain your audience’s attention.

If you decide to create your own postcard, make sure to ask yourself the question, are you using copy and images that will evoke a response from your prospects?

If you speak to the heart of what your target audience is thinking and feeling, you will create a connection that makes people want to reach out to you.

Consistency

Begin your strategic marketing by sending out compelling postcards to a designated area and then do it, again and again. Because this is how often you need to “show up” in your prospect’s mailbox and in their lives to make an impact.

I can not stress this strategy enough due to the positive impact it will have over time. In fact, among other things, it signals to your prospects that you have a quality brand and service.

University of Wyoming’s Anthony McGann and Raymond Marquardt researched the effects of repeat advertising. They found that businesses that advertised with high rates of repetition tend to be rated as “high quality” in consumer report studies.

In addition, the results of another study published in the Journal of Consumer Research showed that consumers think that products and services repeatedly advertised are “good purchase choices”.

Consequently don’t waste time, effort and marketing dollars on a one-hit mailing because it will not have a worthwhile return on investment or positive long-term effect.

Finally, if you are not consistently seen in your targeted market through marketing, consider what message you are sending to your prospects about your level of commitment? Success comes to those who show up over and over again with the right message, the right attitude and the right promise of service.

A powerful database

Your mailing list is not just a compiled list of names and addresses. It represents the lifeblood of your business. And it includes people that, if cared for and kept in touch with, will take care of you for your entire career.

In fact, studies show that one out of twelve on this list will result in a transaction each year. This means a list of 200 will provide you 17 transactions per year. That is if you give them the attention they deserve, by consistently and effectively staying in touch.

Therefore, to keep your list information organized and easy to access choose a database program. But don’t stop with inputting just names, addresses, and phone numbers, also get personal with your entries. Aren’t you impressed when someone remembers your name, asks about your children, spouse, and hobbies?

This is why your database should include spouse and children’s names and don’t forget special interests, likes, dislikes, and personality styles. Begin the habit of contacting your list at least three times a year. Over time you’ll be able to feed more personal details into your database.

Finally, don’t forget about the mailing lists you get when you purchase a Just Listed Postcard. Every time you send a postcard out and do a radial or neighborhood search, for the perfect mailing list – that list is yours to keep. Use it to continue to build that prized book of business. Add these individuals to your database and start building a relationship with them.

For more ideas on how to create a powerful database, download our Free BusinessBASE book. It’s an informative and free resource that explains exactly how to grow your database effectively. And contains information that applies to both short-term and long-term career success.

Start applying these success tricks now. Send the Free Market Analysis Offer postcard from our Free Offer Series to at least 100 new prospects in an area where you want more listings.

Need help? We are here to help you succeed. Just call 866.405.3638 for assistance!

PLUS: When you have a moment…here are 3 Free things to check out that will help you CRUSH IT in 2018!

1. The Free Real Estate Business Plan Outline

Treat your business like a business it is vital to long-term success in this industry. Some agents may put together elaborate business plans, yet there’s something powerful about keeping it simple. Check out the perfect one page Online Real Estate Business Plan – Click Here

2. The Free Marketing ROI Calculator

Consistency and automation are the keys to success. Discover how effective direct mail marketing can dramatically increase your bottom line. Enter your statistics in our Free online ROI Calculator and click the ‘CALCULATE MY ROI’ button to see your results instantly! – Click Here

3. The Free Strategic Marketing Planner

The Real Estate Marketing Planner is a powerful 12-Month-Guide that strategically defines what marketing to do when. Four key market segments are included, Niche Marketing, Listing Inventory, Geographic Farming, and Sphere of Influence – Click Here

Also…check these out 🙂

Turn One Listing Into More – & all from your mobile phone

Automate Your Just Listed/Just Sold Postcards – with MLS Listings

Become a Neighborhood Brand – with the Market Dominator System