Mortgage and rent relief, utility bill forbearance, and a sped-up unemployment compensation process are just a few of the forms of relief offered to Americans during the COVID-19 pandemic.

The list changes almost daily. Unemployment benefits, for instance, were recently extended to independent contractors under the CARES Act.

If you’re not working in real estate right now, which seems to be the prevalent situation across the country, we are offering up some ideas on how to deal with the lack of income during this period.

Let’s talk about that unemployment compensation

The official name for these benefits for the self-employed is “Pandemic Unemployment Assistance (PUA).” As you can imagine, many states were and are completely unprepared for this new program.

Built to accommodate W2 workers, the revamp to state systems to also include the self-employed is a bit sluggish, with some states not yet ready to accept applications.

“States appear to be awaiting guidelines from the Labor Department, and some are updating their administrative processes,” according to Greg Iacurci at CNBC.com.

He goes on to detail the experience of one self-employed Rochester, New York woman who was unable to apply via the website. Apparently, the site demanded a copy of her W2. She phoned the office (it took numerous tries before she got through) and was able to apply by phone and faxed her IRS Schedule C in lieu of the required W2.

How much can you expect to receive in PUA? Iacurci says that the self-employed may “… receive half their state’s average weekly unemployment benefit plus $600 a week.”

A far cry from the average commission check, but it will put food on the table.

Check your state’s unemployment office website for details specific to you. For instance, New York has a handy chart detailing the requirements for PUA in that state.

Get a small business loan

I feel for the higher-earning real estate agents right now. To go from a huge income to nothing has got to be something they never expected.

For these agents, especially those with employees, a small business loan may be the answer.

The Paycheck Protection Program, part of the CARES Act, has $350 billion to offer small businesses.

“The program is designed to get cash into the hands of suffering small businesses quickly, with less red tape and fewer guardrails than the SBA’s existing loan programs,” according to Aaron Gregg at WashingtonPost.com.

The main goal of the program is to help employees remain on the payroll by incentivizing small business owners. The bonus for you is that you may qualify for loan forgiveness.

Get details on the Paycheck Protection Program and learn if you qualify at SBA.gov.

Should you consider raiding your retirement funds?

Because there are very pertinent pros and cons to this question, the answer is a toughie.

Some of the disbursement rules have changed, making it even more tempting to raid your retirement accounts. In the past, there were penalties for early disbursements from these accounts.

Today, account holders are allowed to take, penalty-free, up to $100,000 as a “hardship distribution” from their IRA, 401(k) or 403(b).

You will pay taxes on the disbursement but the CARES Act allows you to spread the payment of these taxes (and the repayment of the disbursement) over three years.

“The biggest consequence of withdrawing money from your retirement plan is that you are losing out on that money compounding,” Mitch Goldberg, financial advisor tells Sharon Epperson at CNBC.com.

If this feels like a good solution for you, run it by your financial planner first. He or she may offer up insights you haven’t considered.

Stay healthy!

Send the Virtual Consultation postcard from the COVID-19 Series to an area where you want more listings.

Need help targeting a specific niche of buyers or sellers? Use our mailing list tool to create the ideal list (it’s easy) or call our support team for assistance at 866.405.3638!

PLUS: When you have time…here are some Free resources we’ve made available to support your success.

1. The 12 Month Done-For-You Strategic Marketing Plan

The Real Estate Marketing Planner is a powerful 12-Month-Guide that strategically defines what marketing to do when. Four key market segments are included, Niche Marketing, Get More Listings, Geographic Farming, and Sphere of Influence. –Click Here

The Real Estate Marketing Planner is a powerful 12-Month-Guide that strategically defines what marketing to do when. Four key market segments are included, Niche Marketing, Get More Listings, Geographic Farming, and Sphere of Influence. –Click Here

2. The Free One-Page Real Estate Business Plan

Treat your business like a business it is vital to long-term success in this industry. Some agents may put together elaborate business plans, yet there’s something powerful about keeping it simple. Check out our one page Online Real Estate Business Plan. – Click Here

3. Become a Listing Legend Free eBook

Ready to take a vertical leap in your real estate career? If you’re looking for inspiration…and the tools and methods to dominate a market and go to the top in real estate…you’ll find them in this free book. – Click Here

Ready to take a vertical leap in your real estate career? If you’re looking for inspiration…and the tools and methods to dominate a market and go to the top in real estate…you’ll find them in this free book. – Click Here

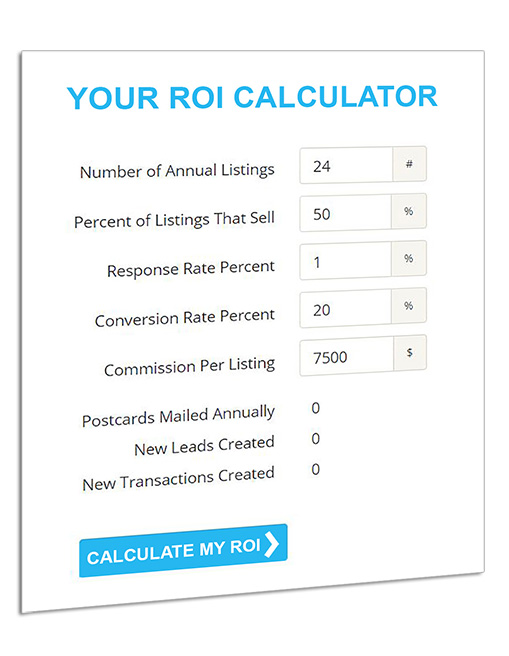

4. The Free Online ROI Calculator

Consistency and automation are the keys to success. Discover how effective direct mail marketing can dramatically increase your bottom line. Enter your statistics in our Free online ROI Calculator and click the ‘CALCULATE MY ROI’ button to see your results instantly! –Click Here

5. The Real Estate Marketing Guide “CRUSH IT”

The “Crush It” Guide includes easy steps to launching an effective direct mail marketing campaign, how to create a targeted mailing list, the perfect way to layout marketing materials for success, seven opportunities available to target in your area right now. –Click Here