Have you Heard? USDA Home Loans Just Got More Attractive to Buyers

Back in October, the U.S. Department of Agriculture enlarged its map of eligible areas for USDA home loans. In fact, “… they added 1,131 areas to its USDA mortgage footprint for 2024 and removed thirty-six,” according to Dan Green at Homebuyer.com.

Even better, is that, while the program still restricts the loans to those buying in rural areas, some of these added areas are now closer to large cities, such as Los Angeles, CA, and San Antonio, TX.

This is important news for agents working with credit- and financially challenged buyers who can’t qualify for a traditional mortgage.

A quick refresher course on what the USDA offers to homebuyers

The USDA home loan programs reside under the umbrella of the Rural Development Agency. This office provides money to low-to-moderate-income families to build, rehab, purchase, and refinance homes within the rural areas it serves. This money comes in the form of direct loans, loan guarantees, and grants.

The two most popular USDA home-buying programs include a direct loan and a guaranteed loan. The former is restricted to those borrowers with low to very low incomes.

Since the applicant borrows the money to purchase the home directly from the USDA, not only is there no down payment required, but closing costs are kept to a minimum.

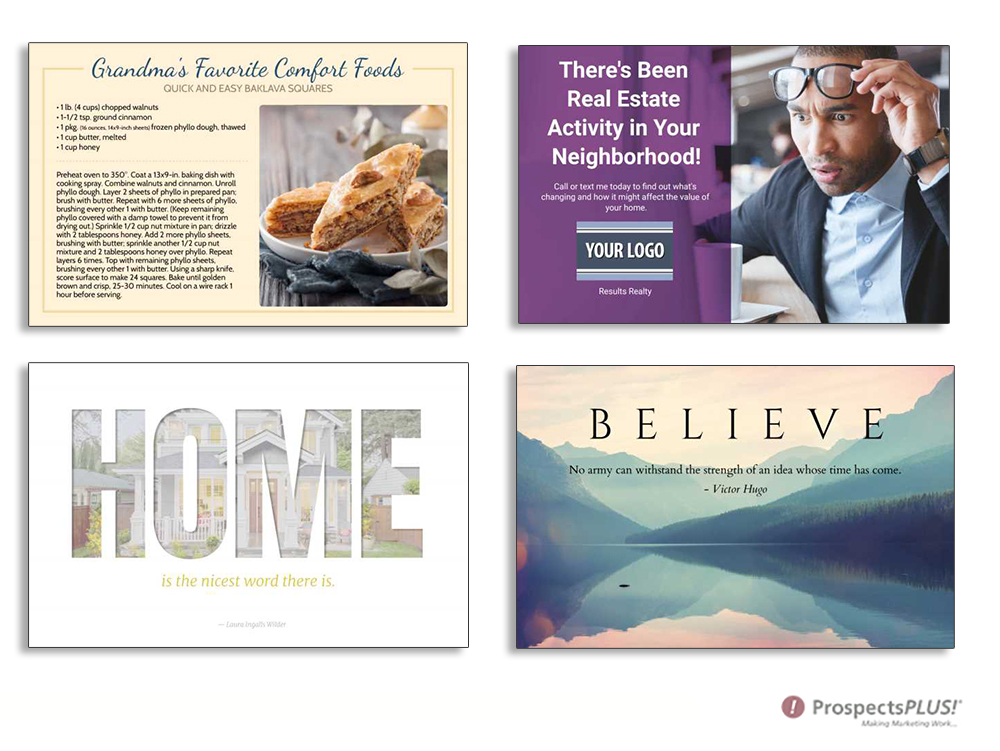

SOI scheduled campaigns are shown above. To learn more, Click Here.

The guaranteed loan, on the other hand, appeals to those with moderate incomes. Although the guaranteed loans are backed by the USDA, they must be obtained through a USDA–approved conventional lender.

Qualifying for a USDA loan involves two aspects. Not only must the borrower qualify, but the house the borrower wishes to purchase must be eligible as well.

Aside from the fact that the home must be located in a USDA-designated rural area (more on that in a moment), it must be considered “modest” for the area. In other words, no swimming pools and no other features that might be considered extravagant or unnecessary.

The USDA has additional requirements that the home must meet, as well.

Borrower eligibility is determined mainly by income and ability to repay the loan. The USDA will look at your client’s credit reports. Late pay and delinquencies may not disqualify a borrower, it depends on the entire financial picture.

Finally, each program has different income requirements.

Understanding the USDA mortgage zones

The USDA divides eligible areas for its mortgage programs into different zones based on population density and other demographic factors. These zones determine the eligibility of properties for USDA-backed loans, which offer favorable terms, including low interest rates and zero down payment requirements.

Historically, these loans have been key to facilitating homeownership in rural areas, serving as an amazing resource for low- to moderate-income homebuyers.

Check the USDA website to find out if the market you serve is among, or near those added to the map. Interested in seeing some of the new rural areas opening up? Check this out!

2. The Free 6-Month Done-For-You Strategic Marketing Planner

The Real Estate Marketing Planner is a powerful 6-Month Guide that strategically defines what marketing to do and when. Four key market segments include niche Markets, geographic farming, sphere of influence, and past clients. – Click Here

3. The Free Online Real Estate Business Plan

The Real Estate Business Plan allows you to enter your business goals for the year and get a breakdown of how many prospects, listings, closings, and so on are needed to reach your financial goals. – Click Here

4. The Become a Listing Legend Free eBook

Ready to take a vertical leap in your real estate career? If you’re looking for inspiration…and the tools and methods to dominate a market and go to the top in real estate…you’ll find them in this free book. – Click Here