Today, we’re offering two tax tips to help take the sting out of 2023.

Home office deductions

And, here you thought the biggest perk to working from home was not having to deal with office politics.

Having a home office offers a slew of tax deductions and, according to Crumbaugh, many agents miss a lot of them.

And, even tenants can take the deduction. So, part of what you pay every month in rent on your home would be deductible.

Some of the more commonly overlooked expenses, a percentage of which can be deducted, include:

- Homeowners or renter’s insurance

- Mortgage interest

- Property taxes

- Utilities

- Repairs and maintenance (of the office area)

- Depreciation

- Casualty losses

As you can imagine, the IRS has a number of stringent requirements to meet before these are considered allowable expenses and they all have to do with whether or not your home office is really an office.

Oh, those silly skeptics at the IRS.

Basically, your home office must be your primary place of business and you must use the space regularly and exclusively.

Read the fine print at IRS.gov.

Assigning work to your kids

Dusting, wiping the mud off signs and lockboxes, and even doing online research are all jobs that your kids can do for you. In fact, if there’s something you normally hire someone else to do, consider hiring your child or grandchild instead.

“The IRS has accepted that your child may be an employee of your business,” says author and attorney, Stephan Fishman at nolo.com.

We aren’t talking about child labor here, but what we’re talking about is well within the limits of the Fair Labor Standards Act. The rules are different when the child is working in a family business.

Now, those are the federal agency’s guidelines. State rules vary, so speak with your accountant or with the state Department of Labor.

You’ll be able to deduct your child’s salary and any fringe benefits you offer, such as health insurance. And, check this out:

Your child won’t be subject to Medicare or Social Security taxes if your business is “a sole proprietorship or a partnership in which each partner is a parent of the child.”

And, if the kids are younger than 21, you won’t have to pay unemployment taxes for them.

Finally, your child won’t have to file a tax return as long as his or her income doesn’t exceed the standard deduction—helpful information when deciding how much to pay the child.

Get more information on hiring your kids from the IRS. We aren’t tax professionals but what we do know is the power of tax deductions. Work with a professional to ensure you get every deduction you are entitled to.

PLUS: When you have time…below are some marketing tools to help support your success.

1. Put Your Real Estate Business a Step Above with Your Own Branded Magazine

Homes & Life Magazine is a customizable magazine with rich, full-color content and a sharp, professional aesthetic. It includes compelling, direct, response-driven articles written by real estate industry experts and engaging lifestyle content. Send out Homes & Life Magazine in Just Minutes – No Minimums Required. Or we’ll ship it to you. Homes & Life Magazine is the ultimate “Coffee Table Lingerer”! …and it costs less than sending a greeting card! – Click Here

2. The Free 6-Month Done-For-You Strategic Marketing Plan

The Real Estate Marketing Planner is a powerful 6-Month Guide that strategically defines what marketing to do and when. Four key market segments include niche Markets, geographic farming, sphere of influence, and past clients. – Click Here

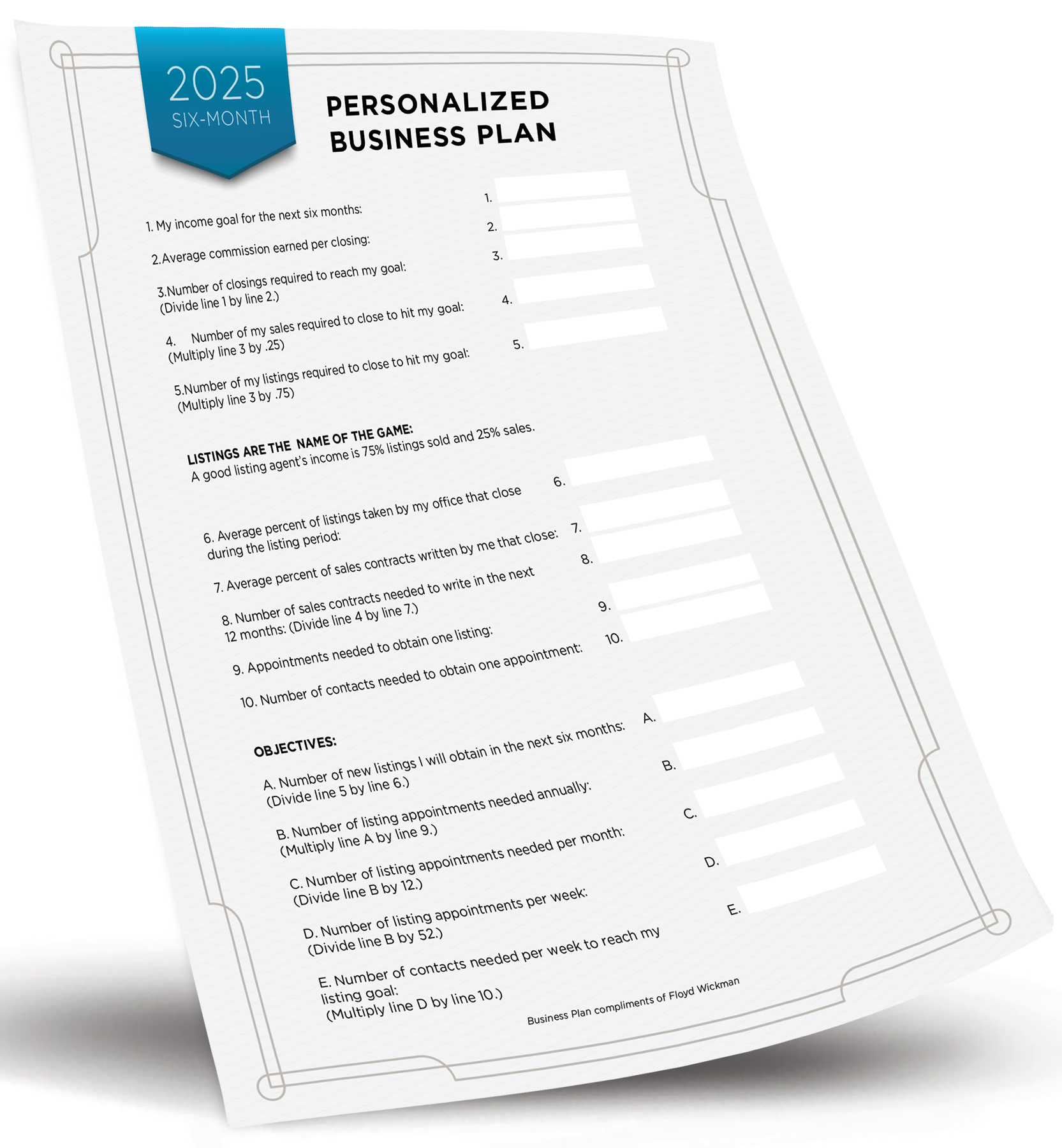

3. The Free Interactive 6-Month Real Estate Business Review

The Free Interactive 6-Month Real Estate Business Review allows you to enter your business goals for the remainder of the year and get a breakdown of how many prospects, listings, closings, and so on are needed to reach your goals. – Click Here

4. The Become a Listing Legend Free eBook

Ready to take a vertical leap in your real estate career? If you’re looking for inspiration…and the tools and methods to dominate a market and go to the top in real estate…you’ll find them in this free book. – Click Here