Many real estate agents routinely write that check to the IRS in April, June, September, and January and do little to nothing more to take the sting out of those payments.

Are you leaving money on the table? Most likely, says a Canadian study.

We’ve rounded up some of the best year-end tax planning strategies we could find. As a bonus, we have some tips on tax strategies to implement in 2020.

Make an IRA contribution

Have you maxed out your IRA contribution for 2019? Those you make to a traditional IRA may be deductible in the year you contribute, according to the IRS (Roth IRA contributions aren’t tax-deductible).

There are several limitations and you can read about these (and find 2019’s limits) at Investopedia.com.

The best part of this tax-saving strategy is that it doesn’t expire at year-end. You have until April 15, 2020, to make your contribution.

Pre-pay expenses

If the devil is truly in the details, then he feels right at home in IRS Schedule C.

Most of your real estate business-related costs are listed in Part II of the schedule, so use it as a roadmap for your year-end tax planning.

If you are planning to hold an event in 2020, consider pre-paying for as many of the expenses as possible. The caterer most likely won’t balk at a prepayment, so if you have the money now, let it flow.

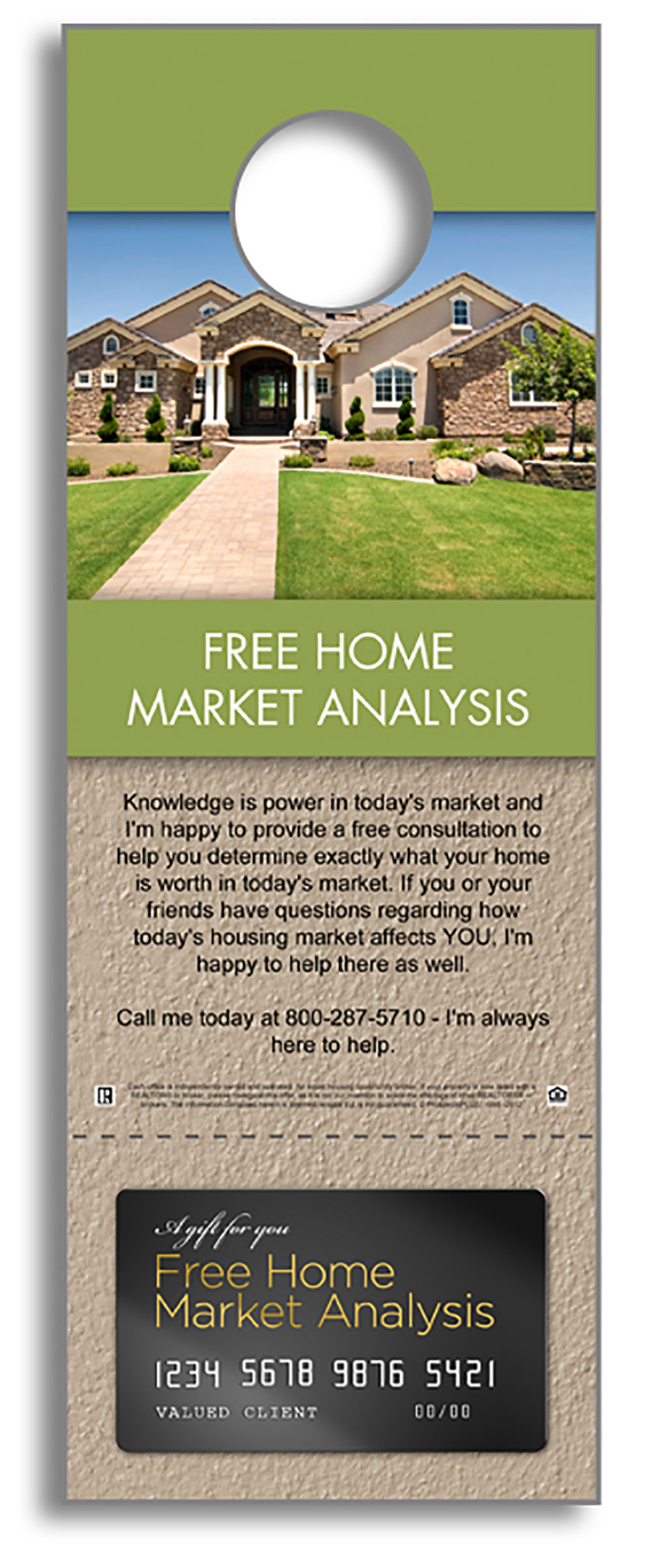

If you regularly spend $2,000 a month for website content, consider pre-paying your writer for the next three months. Pre-pay for Doorhangers, Newsletters, ProspectsPLUS! Gift Cards, and Free Reports, website hosting, your association dues, lockbox fees and the cost of continuing education.

Again, take a look at Schedule C to figure out what you can pay for now that will help boost your deductions.

“By making a bulk purchase at year-end, you’ll get a deduction in the current tax year for that business expense,” according to the TurboTax pros.

Naturally, the IRS has rules around this strategy. “In general, the tax code says that if your prepayment creates an asset, you can’t deduct it until you get the benefit,” according to the pros at wealthfactory.com.

Strategies to implement in 2020

It’s a bit late in the year for some of the best tax-saving strategies, so consider implementing them in 2020.

Work from home

If you’ve been working out of your broker’s office, you’re missing out on one of the best tax savings tactics for small business owners, the home office deduction.

Now, if you’ve considered your broker’s employee and not an independent contractor (or self-employed, whichever you choose to call yourself), the Tax Cuts and Jobs Act (TCJA) took away your ability to use this deduction.

Since most agents are self-employed, however, it pays to move from your broker’s office to a home office. And, by the way, you can still work part-time from your broker’s office. As long as your office at home is where most of the work takes place, you can take the home office deduction.

Hire Your Kids

It’s not a well-known tax-saving strategy, and it requires diligent record-keeping, but hiring your kids to help out in your real estate business will have you writing significantly lower checks to the IRS each quarter.

“The deduction reduces your federal income tax bill, your self-employment tax bill (if applicable), and your state income tax bill (if applicable),” according to Bill Bischoff at marketwatch.com.

Plus, there are benefits for your child as well. “… you can hire your under the-age-of-18 child (as a legitimate employee) and his or her wages will be exempt from Social Security tax, Medicare tax, and federal unemployment (FUTA) tax,”

Your child also won’t pay taxes on the first $12,000 of income (unless he or she has other income).

Yes, there are rules, such as “that the child’s wages must be reasonable for the work performed,” according to Bischoff. In other words, $50.00 an hour to your 8-year old to clean mud off your signs or for your 12-year old to dust the office won’t cut it.

Learn more about hiring your kids at the aforementioned Market Watch link, IRS.gov, and cripca.com.

Attend a conference or convention

Conferences and conventions offer so much to the real estate agent. From inspiration to tips on how to generate leads to how to run your business more efficiently, they’re worth the price of admission. And, that price, by the way, is tax-deductible, as is part of the cost of travel and meals.

Get started now to save money on your 2020 taxes.

Order at least 100 Free Market Report Door Hangers from the Door Hangers Series before year-end and keep them in your car to hang on the doors of prospective clients.

Need help targeting the perfect niche of buyers or sellers? Use our mailing list tool to create the ideal list (it’s easy) or call our support team for assistance at 866.405.3638!

PLUS: When you have time…here are Free killer tools to help your success this year!

1. The 12 Month Done-For-You Strategic Marketing Plan – NEW 2020!

The Real Estate Marketing Planner is a powerful 12-Month-Guide that strategically defines what marketing to do when. Four key market segments are included, Niche Marketing, Get More Listings, Geographic Farming, and Sphere of Influence. –Click Here

The Real Estate Marketing Planner is a powerful 12-Month-Guide that strategically defines what marketing to do when. Four key market segments are included, Niche Marketing, Get More Listings, Geographic Farming, and Sphere of Influence. –Click Here

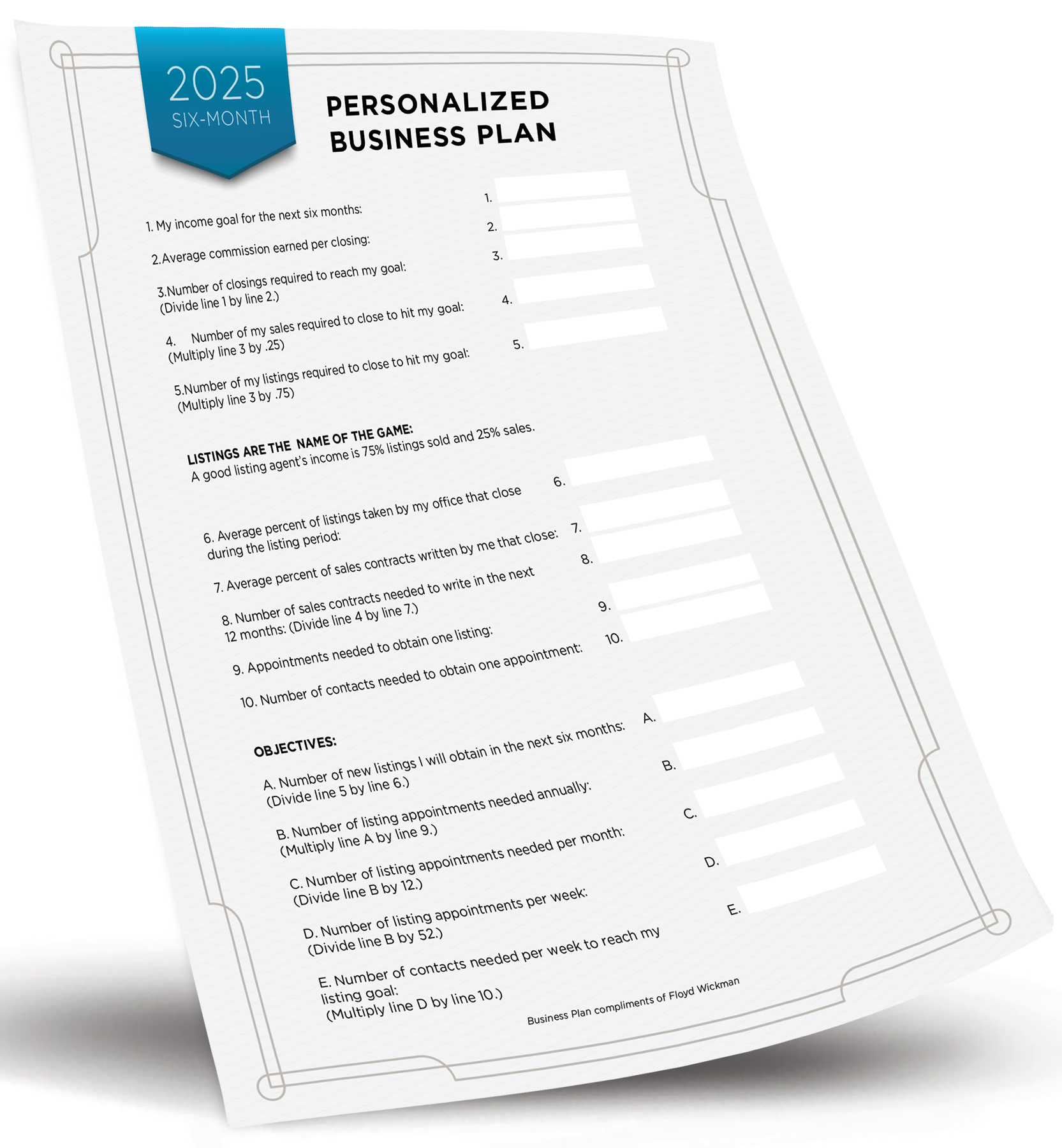

2. The Free One-Page Real Estate Business Plan – NEW 2020!

Treat your business like a business it is vital to long-term success in this industry. Some agents may put together elaborate business plans, yet there’s something powerful about keeping it simple. Check out our one page Online Real Estate Business Plan. – Click Here

3. Get the ALL-NEW Real Estate Marketing Guide “CRUSH IT”

The “Crush It” Guide includes easy steps to launching an effective direct mail marketing campaign, how to create a targeted mailing list, the perfect way to layout marketing materials for success, seven opportunities available to target in your area right now. –Click Here

4. Become a Listing Legend Free eBook

Ready to take a vertical leap in your real estate career? If you’re looking for inspiration…and the tools and methods to dominate a market and go to the top in real estate…you’ll find them in this free book. – Click Here

Ready to take a vertical leap in your real estate career? If you’re looking for inspiration…and the tools and methods to dominate a market and go to the top in real estate…you’ll find them in this free book. – Click Here

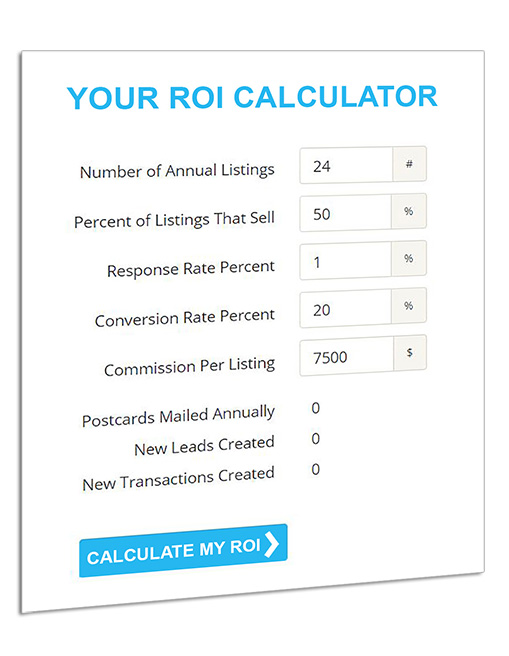

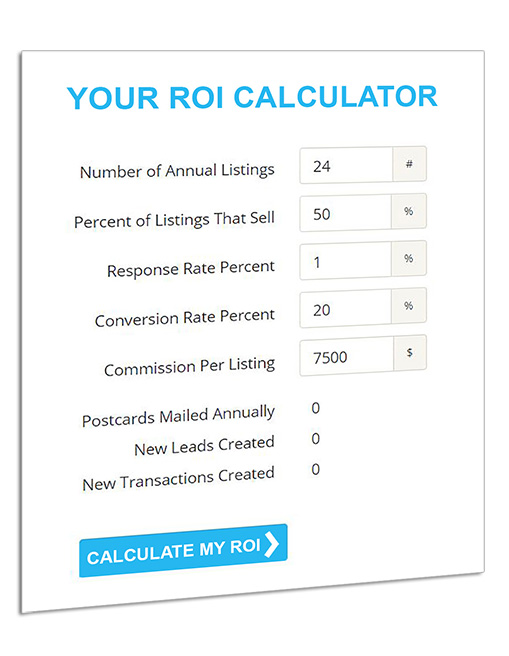

5. The Free Online ROI Calculator

Consistency and automation are the keys to success. Discover how effective direct mail marketing can dramatically increase your bottom line. Enter your statistics in our Free online ROI Calculator and click the ‘CALCULATE MY ROI’ button to see your results instantly! –Click Here