“Hello Mary, this is Edith at the IRS and I notice that you missed claiming several deductions on your tax return,” is a phone call nobody ever has or ever will receive.

Yet, despite all the terms and conditions placed on them, about 39.6 million Americans claim more than $1.1 trillion in tax deductions on itemized returns.

Sounds like a ton-o’-money, doesn’t it?

Consider this: 2.2 million tax filers who didn’t itemize, but took the standard deduction instead, gave the government nearly $1 billion that they didn’t have to.

Sure, itemizing is a hassle but that’s why we hire accountants, right? Your only job is to keep track of all of your expenses.

And, as a real estate professional, you have a lot of expenses that can be transformed into deductions.

Document everything

Guesstimates of your mileage, how much gas you used and other auto-related expenses will get you about as far as a Zestimate gets a homeowner looking for home value.

Relying on them may cause you to leave money on the table.

Then, the IRS requires accurate documentation, should you be audited.

“The devil is in the detail,” warns Bill Zumwalt, former tax coach to real estate agents. “If you have documentation, it will be your friend.”

OK, so let’s jump into some of the more common automobile deductions that apply to the real estate professional and some tips on how to document them.

The Empty Nest Series is shown above, Click Here.

Bought a car in 2023?

Yup, it’s a fact: being a buyer’s agent means practically living in your car.

Without getting too technical, if you’re thinking of getting a new tin can to be locked up in all day, and it happens to be a “heavy” SUV, you may want to purchase or lease a 2024 model.

A heavy SUV, by the way, would be something like a Tahoe or Land Cruiser— any vehicle with a gross vehicle weight rating (GVWR) of more than 6,000 pounds. You can find a list of qualified vehicles at mileiq.com.

The depreciation deduction falls under Section 179 of the IRS code. “Section 179 is a provision of the US tax code that allows businesses to deduct (i.e., write off) the purchase price of qualifying equipment, vehicles, and software in the year it was purchased, as opposed to depreciating it a little at a time over several years,” according to the experts at Crest Capital.

You can bone up on the details at IRS.gov.

Deductible auto expenses

Keep careful records of your mileage this year because you’ll get more money per mile than you did last year: 65.5 cents per mile driven for business use.

And, keep in mind that mileage may just be your biggest tax deduction, according to CPAs at Rick C. Reed and Company in Texas.

Don’t neglect the following expenses, though:

- Car washes

- Repairs

- Gas (including tax on gas)

- Tires

- Parking

- Tolls

- Depreciation

- Maintenance costs

- Vehicle registration fees

- Lease payments

- Insurance

Learn more about vehicle expenses online at IRS.gov.

2. The Free 6-Month Done-For-You Strategic Marketing Plan

The Real Estate Marketing Planner is a powerful 6-Month Guide that strategically defines what marketing to do and when. Four key market segments include niche Markets, geographic farming, sphere of influence, and past clients. – Click Here

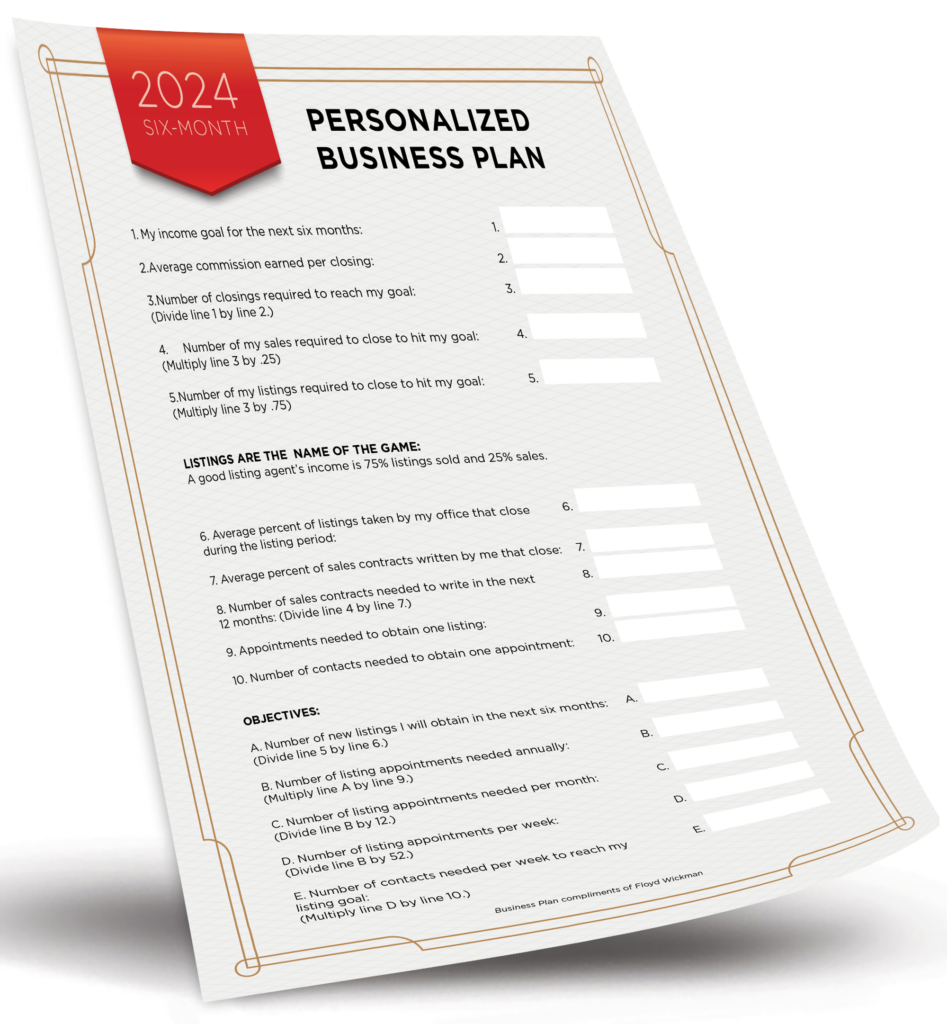

3. The Free Interactive 6-Month Real Estate Business Review

The Free Interactive 6-Month Real Estate Business Review allows you to enter your business goals for the remainder of the year and get a breakdown of how many prospects, listings, closings, and so on are needed to reach your goals. – Click Here

4. The Become a Listing Legend Free eBook

Ready to take a vertical leap in your real estate career? If you’re looking for inspiration…and the tools and methods to dominate a market and go to the top in real estate…you’ll find them in this free book. – Click Here