If you’re not familiar with the Neighborhood Assistance Corporation of America (NACA) and their homebuying program, you should probably remedy that.

With lenders instituting “… the toughest loan-approval standards in years,” according to Joe Light at Bloomberg.com, many buyers who are on the margins may be seeking the organization’s help.

There are a few twists and turns in the NACA mortgage transaction that both buyer and seller agents need to know about.

First, some background

NACA is not a lender, but a “non-profit, community advocacy and homeownership organization,” according to the NACA website. The group’s focus is low-to-moderate income homebuyers who are registered to vote.

The organization is certified by HUD to meet its goal of helping to provide affordable homeownership, with the same terms for all of its members.

Self-titled “America’s Best Mortgage Program,” NACA’s terms include providing loans with:

- No down payment or closing costs

- No fees, no points

- Rates are fixed and below market

- Credit score isn’t taken into consideration

To get the mortgage, the buyer must join NACA by paying a $25 membership fee (payable every year, and agreeing to take part in “. . . five actions and activities a year and at least one prior to NACA Qualification and one prior to closing …”

Sounds great, doesn’t it?

And, it is, and will be for the buyers on the fringe of qualification who may be locked out of the market by the new, more-stringent loan qualification standards.

For agents and home sellers, however, it’s a whole different story. Many that we’ve spoken with call the program’s transactions “nightmares.”

One listing agent said that her seller almost removed her listing because of the challenges she was forced to endure and the long (very long) escrow period.

The agent’s part in the process

First, you should know that NACA has its own roster of buyers’ agents and they strongly encourage their members to use them.

Because these agents have experience with the process, they do have a lot to offer the buyer. But if your buyer decides that a NACA mortgage is the only way to “achieve the dream,” you’ll need to protect your interests.

Get a signed buyer’s broker agreement before your client attends the first workshop.

And, don’t bother recommending your favorite home inspector because buyers are required to use “… a licensed home inspector who either is or will be registered with NACA and agrees to use the HomeGauge software,” according to the organization’s website.

Although the organization claims to close most loans in 28 days, we’ve heard from several agents who experienced repeated requests for contract extensions and two said the deals took five months to close.

NACA also specifies that buyers demand the removal of the following from the purchase agreement:

- Forfeiture of earnest money if the buyer can’t qualify for the loan or the home doesn’t appraise.

- Penalties for not closing on time

The contract must include:

- A contingency that the home is approved by NACA-approved home and pest inspectors

- A closing date of at least 30 days, longer if the home requires work

- Settlement services must be provided by an approved NACA settlement agent

Ok, suppose you are working with a new buyer who tells you he or she will be applying for the NACA mortgage. The most important next question is “Have you been in touch with anyone from NACA?”

And here is why this question should be first:

If the buyer “has been involved with or been in previous contact with NACA at the time the Member [your potential buying client] is referred to the Program, you will not be able to register them to your name,” according to NACA’s website.

The organization has a whole slew of rules for outside agents who bring in buyers and you can catch up with those at nacalynx.com.

Or, you could become a NACA-approved agent

The organization is actively seeking real estate agents, nationwide, so if you’re looking for an additional source of leads, you may want to look into it.

Get the details online at workforcenow.adp.com.

Send the Rent Race postcard from the Rent By Numbers Series to a Renter Prospect List in your area or near your Farm.

Need help targeting renters? Use our Demographic Search Tool to create the ideal list (it’s easy) or call our support team for assistance at 866.405.3638!

PLUS: When you have time…here are some helpful resources we’ve made available to support your success.

1. The Free Real Estate Mailing List Guide

The Real Estate Mailing List Guide outlines the top tools for generating targeted prospecting lists including Baby Boomers, Empty Nesters, Investors, Lifestyle Interests, High-Income Renters, Move-Up Markets, and more. The Guide also defines done-for-you marketing campaigns to match these markets. –Click Here

2. The Free 12 Month Done-For-You Strategic Marketing Plan

The Real Estate Marketing Planner is a powerful 12-Month-Guide that strategically defines what marketing to do when. Four key market segments are included, Niche Marketing, Get More Listings, Geographic Farming, and Sphere of Influence. –Click Here

3. The Free One-Page Real Estate Business Plan

Treat your business like a business it is vital to long-term success in this industry. Some agents may put together elaborate business plans, yet there’s something powerful about keeping it simple. Check out our one page Online Real Estate Business Plan. – Click Here

4. Become a Listing Legend Free eBook

Ready to take a vertical leap in your real estate career? If you’re looking for inspiration…and the tools and methods to dominate a market and go to the top in real estate…you’ll find them in this free book. – Click Here

5. The Market Dominator Branding System

Become branded in a specific neighborhood with a mega-marketing piece sent automatically each month to an exclusive carrier route. (Watch this video on the Market Dominator, below). For more information Click Here.

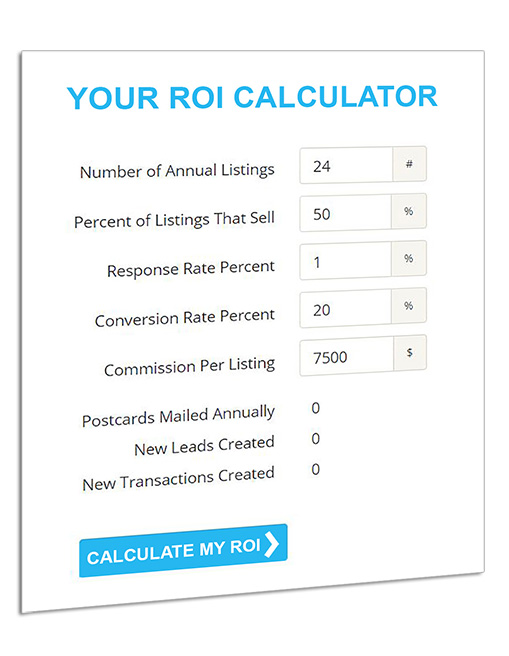

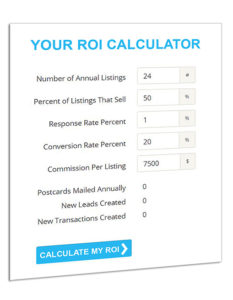

6. The Free Online ROI Calculator

Consistency and automation are the keys to success. Discover how effective direct mail marketing can dramatically increase your bottom line. Enter your statistics in our Free online ROI Calculator and click the ‘CALCULATE MY ROI’ button to see your results instantly! –Click Here

7. The Free Real Estate Marketing Guide “CRUSH IT”

The “Crush It” Guide includes easy steps to launching an effective direct mail marketing campaign, how to create a targeted prospect list, the perfect way to layout marketing materials for success, seven opportunities available to target in your area right now. –Click Here