4 Steps to challenging the appraisal

In September of 2012, one in three real estate deals had appraisal problems. It was post-recession and we hit the bottom of the housing market in the early months of the year.

Although home prices rose slowly (at least in the beginning), stringent mortgage lending requirements and “appraisal frictions,” as NAR’s Lawrence Yun called them, caused many a real estate deal to fall apart.

We’re currently in a period of flux with the housing market with signs pointing to a buyers’ market, but nobody is truly certain of what’s to come. What we do know is that, while they won’t be as difficult as those in 2012, there may be more appraisal challenges on the horizon.

As a new agent dealing with VA clients, getting up to speed on the VA loan process is challenging enough. Dealing with a low VA appraisal takes a special kind of finesse, so let’s walk through the process.

Thankfully, you have options

When your clients are dealt a low appraisal from a conventional lender’s appraiser, there is little that can be done aside from asking for another appraisal or challenging the appraiser.

Loans guaranteed by the VA, however, are a different breed. Borrowers have the leverage provided by a process called the Reconsideration of Value (ROV).

It takes a team to request a ROV, so you’ll need to enlist the other side’s real estate agent and the sellers.

Step 1: Nit-pick the appraisal

The first step relies heavily on both the listing agent and his or her clients. Nobody involved in the deal knows more about the neighborhood than these parties, and their knowledge is critical in the ROV process.

Ask them to go over the appraisal, looking for errors and omissions. Even the tiniest of mistakes can make a difference, so request that they be as picky as possible.

- Check to ensure the appraiser got the home and the lot square footage correct.

- Is the age of the home accurate? How does it compare to those of the comps the appraiser used?

- Were the home’s upgrades considered? Energy efficient improvements are especially important in the VA appraisal.

- How does the home’s location compare to that of the comps?

While the sellers and their agent are doing their part, you should go into the MLS and ensure that every bit of information about the comps that the appraiser used is accurate.

Take your time and be methodical. Finding mistakes may just save the deal.

Step 2: You’ll need to pick the seller’s brains

Actually, you’ll need to ask their agent to pick their brains. Ask them to think back to any conversations they’ve had with neighbors about home sales in the area. Anything that caused the sale to be more or less than market value is important.

For instance, Joe down the street got a job in Boston and his new employer needed him there immediately. He had to sell his home and, in his rush to relocate, he took a rock-bottom offer.

A death in a family, selling to a family member and a tough divorce are a few other reasons that homes sometimes sell for less than market value.

Also, ask if there were any recent FSBO sales in the area and learn as much as you can about those situations as well.

Finally, run a CMA on the property to see if there are more relevant sales that the appraiser missed.

Step 3: Organize your supporting information

The VA has specific demands when submitting information for a ROV. Some lenders will handle this for you, but to be safe, thorough and professional, submit the information to the lender in the required format.

Comparable sales should be submitted on a grid. See the grid form the lender is required to submit at eprmg.net.

- Ensure that the comps are truly “superior” to those used by the appraiser, such as comps that are more recent, closer in proximity to the subject property or more similar.

- These comps must have a closing date earlier than the date on which the VA appraisal was reported and the VA will accept no more than three.

- Include the MLS printouts (with closed status) for each comp.

- Also, include a written narrative on why you think the comps are superior to the ones used by the appraiser. This is where you’ll mention any special circumstances, such as those listed in Step 2.

If the request for ROV is based on a disagreement with how the appraiser analyzed data, you’ll need to approach the lender with different materials:

Submit a narrative outlining which aspects of the appraisal you disagree with and why you think they’re incorrect. “Disagreement(s) with items such as grid adjustments, or subject square footage measurement should be explained and any documentation available to support these disagreement(s) should also be provided,” according to the VA.

Step 4: It’s time to approach the lender

The lender is the middle man or woman in a VA transaction – between the VA appraiser and the buyers and sellers.

He is the person you’ll want to speak with about the ROV and he is the person who will transmit all the supporting documents you come up with.

He’ll supply the appraiser with those documents and the appraiser will have five days to go over everything, reevaluate the original appraisal and notify the lender and the VA of her results.

Your job at this point is to wait for the VA review process to conclude. Hopefully, all will go in your client’s favor because the results of the VA ROV are final.

Valentine’s Day is on its way (already) and right now is the perfect time to get those Valentine’s postcards in the mail.

Send at least 100 Valentine’s postcards from the Holiday Series to your Sphere of Influence.

Need help targeting the perfect niche of buyers or sellers? Use our mailing list tool to create the ideal list (it’s easy) or call our support team for assistance at 866.405.3638!

PLUS: When you have time…here are 4 free ways we can help you have an INVINCIBLE 2019!

1. Become a Listing Legend Free eBook

Ready to take a vertical leap in your real estate career? If you’re looking for inspiration…and the tools and methods to dominate a market and go to the top in real estate…you’ll find them in this free book. – Click Here

2. The Free One-Page Real Estate Business Plan

Treat your business like a business it is vital to long-term success in this industry. Some agents may put together elaborate business plans, yet there’s something powerful about keeping it simple. Check out our one page Online Real Estate Business Plan – Click Here

3. The 12 Month Done-For-You Strategic Marketing Plan

The Real Estate Marketing Planner is a powerful 12-Month-Guide that strategically defines what marketing to do when. Four key market segments are included, Niche Marketing, Listing Inventory, Geographic Farming, and Sphere of Influence – Click Here

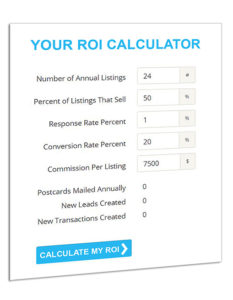

4. The Free Online ROI Calculator

Consistency and automation are the keys to success. Discover how effective direct mail marketing can dramatically increase your bottom line. Enter your statistics in our Free online ROI Calculator and click the ‘CALCULATE MY ROI’ button to see your results instantly! – Click Here

Also…check out these game-changing tools!

Three Click Postcards – Just snap a home photo & create a postcard all from your mobile phone

MLSmailings.com – Automated Just Listed, Just Sold Postcards

Market Dominator System – Become a neighborhood brand & achieve 20% market share

Want to Refer a friend or colleague? Refer them, Here. THEY get a Free $25 Gift Card and YOU become their hero. BTW, you also get a $25 Gift Card too (now that’s what I’m talking about)!

Our business flourishes from recommendations (similar to yours). We truly appreciate when you leave a review – Review us here