Success as a real estate agent often hinges on negotiating effectively and delivering compelling listing presentations.

For real estate agents looking to up their game and stand out in a competitive market, honing these skills is paramount.

Negotiation Skills

Negotiation lies at the heart of every real estate transaction, making it crucial for agents to master this art.

Effective negotiation involves more than just haggling over prices; it requires clear communication, strategic thinking, and building rapport with clients and counterparties alike.

Continuous education and training

Sharpening negotiation skills as begins with a commitment to continuous learning and professional development.

The Real Estate Times Series is shown above. To learn more, Click Here.

Seek out specialized training programs, workshops, and seminars focused specifically on negotiation techniques tailored to the real estate industry. There are several options available through online platforms like Harvard Business School, Udemy, and various organizations nationwide. Or you can find endless YouTube videos, podcasts, and books dedicated to this subject.

Additionally, consider joining professional organizations or networking groups where you can exchange insights and strategies with fellow real estate professionals.

By staying informed about the latest trends and best practices in negotiation, you can enhance your ability to navigate complex transactions and achieve favorable outcomes for your clients.

Practice and role-playing

Like any skill, negotiation requires practice to master. Dedicate time to honing your negotiation skills through role-playing exercises and simulated scenarios.

Practice negotiating various aspects of a real estate transaction, such as price, terms, and contingencies, with colleagues or mentors acting as clients or counterparties.

Role-playing allows you to test different strategies, refine your communication techniques, and build confidence in your ability to negotiate effectively in real-world situations. Embrace feedback and constructive criticism to identify areas for improvement and fine-tune your approach over time.

Understand client needs and market dynamics

Effective negotiation in real estate hinges on a deep understanding of both your client’s objectives and the broader market dynamics at play.

Take the time to listen to your client’s concerns, priorities, and preferences, and tailor your negotiation strategy accordingly.

Conduct thorough research into market trends, comparable properties, and local market conditions to identify opportunities and anticipate potential challenges during negotiations.

By aligning your approach with your client’s goals and leveraging your knowledge of the market, you can negotiate with confidence and achieve the best possible outcomes for your clients.

Listing Presentation Skills

A compelling listing presentation is key to winning clients and securing valuable listings.

Begin by thoroughly researching the property and its neighborhood to understand its unique selling points and market value.

Arrive at the presentation armed with data and insights that demonstrate your expertise and reassure the seller of your ability to represent their property effectively.

Additionally, personalize your approach by considering the seller’s specific needs and motivations. Then, tailor your presentation to address their concerns, and highlight how you can meet their goals.

Show don’t tell

During the presentation, focus on building rapport and trust with the seller. Take the time to actively listen to their needs and preferences, and be prepared to address any questions or concerns they may have.

Present yourself as a knowledgeable and trustworthy advisor who is committed to guiding them through the selling process with confidence.

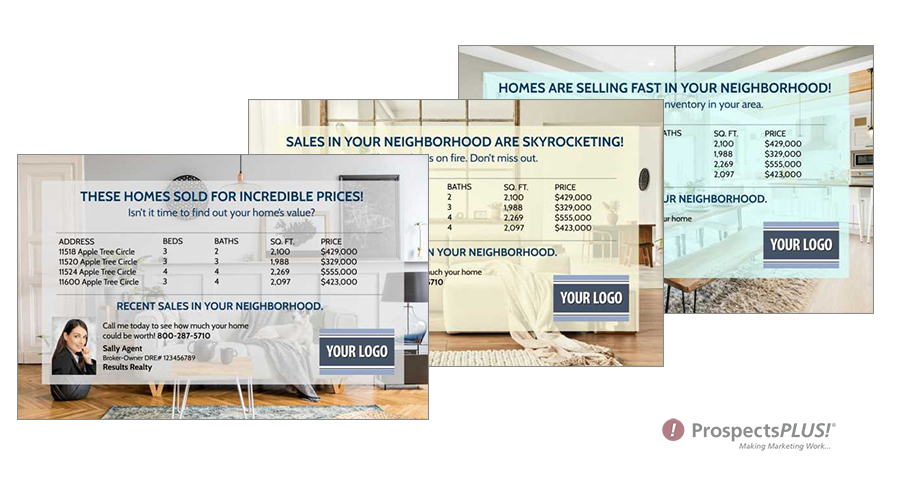

Utilize visual aids such as market trends, comparative market analyses, and professional marketing materials to support your arguments and showcase your dedication to achieving the best possible outcome for the seller.

Value proposition

Differentiate yourself from the competition by highlighting your unique value proposition and the benefits of working with you as their realtor.

Emphasize your track record of success, your comprehensive marketing strategy, and your proactive approach to communication and negotiation.

Share stories about successes with past clients, including challenging listings and how you overcame them.

By investing time and effort into mastering negotiation and listing presentation skills, you can enhance your value proposition, win more clients, and achieve greater success in the competitive real estate industry.

2. The Free 6-Month Done-For-You Strategic Marketing Planner

The Real Estate Marketing Planner is a powerful 6-Month Guide that strategically defines what marketing to do and when. Four key market segments include niche Markets, geographic farming, sphere of influence, and past clients. – Click Here

3. The Free Online Real Estate Business Plan

The Real Estate Business Plan allows you to enter your business goals for the year and get a breakdown of how many prospects, listings, closings, and so on are needed to reach your financial goals. – Click Here

4. The Become a Listing Legend Free eBook

Ready to take a vertical leap in your real estate career? If you’re looking for inspiration…and the tools and methods to dominate a market and go to the top in real estate…you’ll find them in this free book. – Click Here