The Spotlight Feature Property Magazine is shown above. To see more, CLICK HERE

While it certainly feels like everything we do in today’s world is digitized, printed marketing is a powerful medium with an impressive 29% average ROI.

In fact, many organizations are returning to print options as a facet of their overall marketing approach. Personalized magazines have a long history as an effective strategy to build brand trust and loyalty.

And, real estate professionals are beginning to understand this and use this unique tool to engage their audience and create relationships.

1. Branding sets the stage

Digital tools can help professionals reach a broad audience, but a personally branded print magazine is a way to create an entire atmosphere that engages readers through multiple senses.

A magazine can sell more than just a few properties—it can also sell the lifestyle and vibe of the property and neighborhood. People build emotional connections with homes they can see themselves thriving in, and placing a curated, personalized magazine in front of them helps them visualize the life they want.

2. Cuts through the online noise

Internet listings can potentially reach a global audience, but getting lost in a vast online crowd is easy to do. Standing out is a challenge in a sea of listings.

Many customers respond positively to what feels like a personalized touch—and that’s where your branded magazine shines. By incorporating local activities and businesses into your magazine you can deliver an experience that feels tailored to the reader and the local area.

Online marketing is so ubiquitous that it becomes overwhelming, and many people tune it out. In a branded magazine, your personal showcase is part of an overall story and is far more likely to make an impression.

3. Partners well with other marketing

Personally branded real estate magazines are not the opposite of digital or social media marketing; they are the partner to it. A magazine is a tangible asset that can give potential clients something physical to browse through and engage with.

Links within the magazine can direct them to virtual tours, photos, and more. Pairing branded print magazines with online resources can deliver a more holistic experience for clients.

4. The link to luxury

Luxury listings often have many amenities, but simply listing them off is not very attractive. Many potential clients in the luxury market actually expect branded print magazines to be available and view them as a sign of exclusivity.

A tailored, slickly photographed magazine communicates that this property or area is truly something special, and now that the client has discovered it, they will want to be a part of it.

5. Lasts long after it’s received

Real estate magazines can be long-lasting gifts that keep giving. Even though the properties listed inside may have long since sold, the magazine can continue to deliver leads and positive engagement.

The ‘story’ that the personally branded magazine tells will still draw clients in. Additionally, statistics show that magazine media can create more positive feelings than other media types.

Personally branded real estate print magazines add value to clients by delivering relevant and helpful information.

This type of marketing also cultivates a memorable and trusting relationship. Consider integrating The Spotlight, Feature Property Magazine, and/or Homes & Life Magazine into your portfolio of client outreach for a cost-effective way to drive listings and increase meaningful engagement.

To send out The Spotlight Magazine or Homes & Life Magazine or learn more, click the “See Your Magazine Now” yellow button below.

Watch This Video Below to Learn How to Easily Send Out a Homes & Life and The Spotlight Magazine!

PLUS: When you have time…below are some marketing tools to help support your success.

1. The Free 12 Month Done-For-You Strategic Marketing Plan

The Real Estate Marketing Planner is a powerful 12-Month-Guide that strategically defines what marketing to do when. Four key market segments are included, niche Markets, geographic farming, sphere of influence, and past clients. – Click Here

2. The BusinessBase, SOI building system

The most effective thing you can do to build a real estate business is to become more visible, more likable, and remembered more often. The BusinessBASE™ not only checks all of these boxes, but it is a business building machine. In two easy steps, you can begin to build a robust sphere of influence that will provide you a lifetime of repeat business and referrals. – Click Here

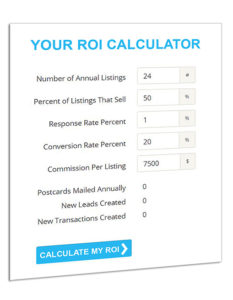

3. The Free Interactive Real Estate Business Plan

The Free Interactive Real Estate Business Plan allows you to enter your business goals for this year and get a breakdown of how many prospects, listings, closing, and so on are needed to reach your goals. – Click Here

4. The Become a Listing Legend Free eBook

Ready to take a vertical leap in your real estate career? If you’re looking for inspiration…and the tools and methods to dominate a market and go to the top in real estate…you’ll find them in this free book. – Click Here

5. The Take a Listing Today Podcast

Watch the ProspectsPLUS!, Take a Listing Today Podcast for actionable content to help you get more listings. – Click Here